NoteDOCTOR

Note Business

Your Prescription For Secure Investments

Mortgage Notes | Real Estate | Development Projects | Joint Ventures Let's Invest Together

I have Notes available now for a passive cash flow for you.

OUR SOCIAL MEDIA

Your Prescription For Secure Investments

Mortgage Notes | Real Estate | Development Projects | Joint Ventures Let's Invest Together

I have Notes available now for a passive cash flow for you.

OUR SOCIAL MEDIA

WHAT WE ARE OFFERING

EXPLORE ALTERNATIVE INVESTMENTS FOR ACCREDITED AND NON-ACCREDITED INVESTORS.

Select the right area to invest, identify problems before buying, find opportunities, buy/sell at the right price.

Learn about the legal structure many real estate investors are putting in place to protect their hard-earned money from frivolous lawsuits. Discuss with Ivan Learn More.

Receive tips about investing and information about Real Estate and Mortgage Note investment opportunities.

Receive a free pocket guide and access to a Note Investing Video Course when you register.

WHAT WE ARE OFFERING

EXPLORE ALTERNATIVE INVESTMENTS FOR ACCREDITED AND NON-ACCREDITED INVESTORS.

Select the right area to invest, identify problems before buying, find opportunities, buy/sell at the right price.

Learn about the legal structure many real estate investors are putting in place to protect their hard-earned money from frivolous lawsuits. Discuss with Ivan Learn More.

Receive tips about investing and information about Real Estate and Mortgage Note investment opportunities.

Receive a free pocket guide and access to a Note Investing Video Course when you register.

1st Trust Deed

$1,200,000

Point Loma, CA

Payment

$12,000

Property Value

$7,400,000

Loan Terms: 12

I/O: 6Mo,

Int.Prepaid

1st Trust Deed (4 Property CC)

$1,500,000

San Clemente, CA

Payment

$17,000

Property Value

$9,300,000

Loan Terms: 12

I/O: 3Mo,

Int.Prepaid

2nd Trust Deed

$900,000

Los Angeles, CA

Payment

$9,400

Property Value

$1,400,000

Loan Terms: 24

I/O: 12Mo,

Int.Prepaid

1st Trust Deed

$1,200,000

Point Loma, CA

1st Trust Deed (4 Property CC)

$1,500,000

San Clemente, CA

2nd Trust Deed

$900,000

Los Angeles, CA

Payment

$12,000

Property Value

$7,400,000

Loan Terms: 12

I/O: 6Mo,

Int.Prepaid

Payment

$17,000

Property Value

$9,300,000

Loan Terms: 12

I/O: 3Mo,

Int.Prepaid

Payment

$9,400

Property Value

$1,400,000

Loan Terms: 24

I/O: 12Mo,

Int.Prepaid

RECENTLY FUNDED

2023

2nd Trust Deed

FUNDED

Chula Vista, CA

Payment

$33,333.33

Property Value

$2,535,000

Loan Terms: 12

I/O

2023

2nd Trust Deed

FUNDED

Shelby Township, MI

Payment

$42,000.40

Property Value

$3,400,000

Loan Terms: 12

I/O

RECENTLY FUNDED

2023

2nd Trust Deed

FUNDED

Chula Vista, CA

2023

2nd Trust Deed

FUNDED

Shelby Township, MI

Payment

$33,333.33

Property Value

$2,535,000

Loan Terms: 12 I/O

Payment

$42,000.40

Property Value

$3,400,000

Loan Terms: 12 I/O

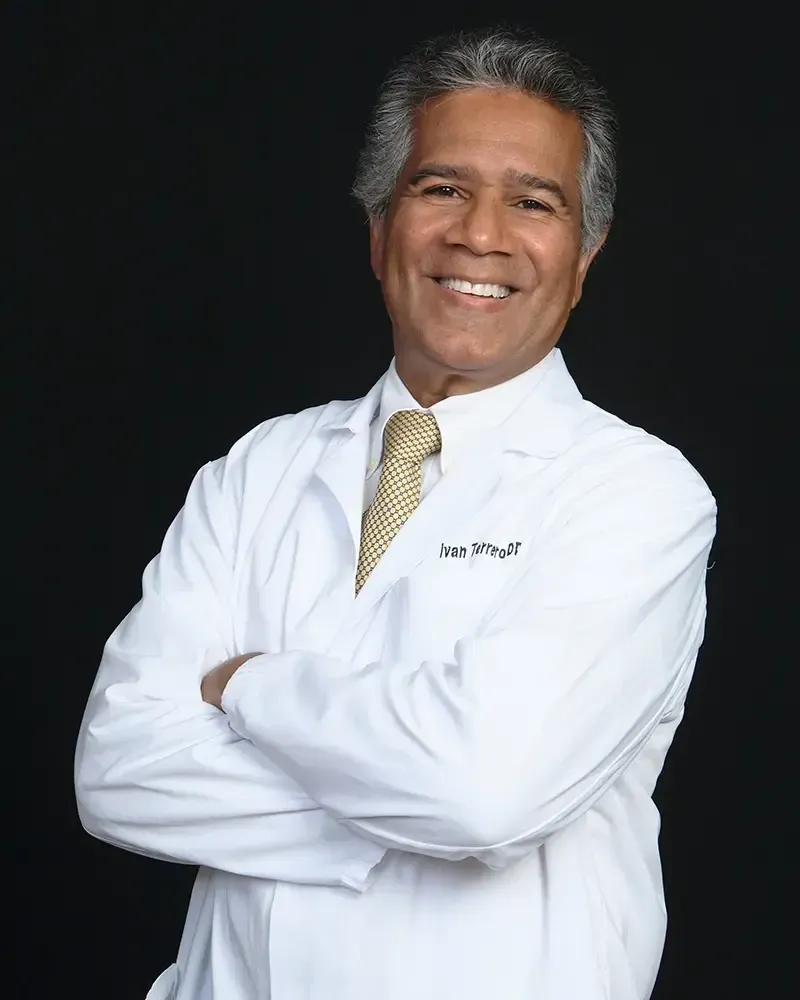

ABOUT ME

My name is Ivan Terrero.

I have known that I wanted to be a dentist since I was 13 years old.

I graduated in 1986 in the Dominican Republic

to further my dentistry career and have now been practicing for 32 years, currently in Florida.

I've been involved with real estate investing for the last 25 years, buying land, offering creative financing including rent-to-own, being a private lender and flipping properties.

Today my preference is investing in mortgage notes and looking for real estate investment partners.

A mortgage note is a promissory note secured by property. The buyer makes payments to the Note holders as they would to a bank or other lender.

My goal is to grow a portfolio of investments with partners to provide cash flow and financial security.

Work with me to expand your investment portfolio to include real estate assets and mortgage notes.

I can work with you in Spanish.

— Ivan Terrero, The Note Doctor

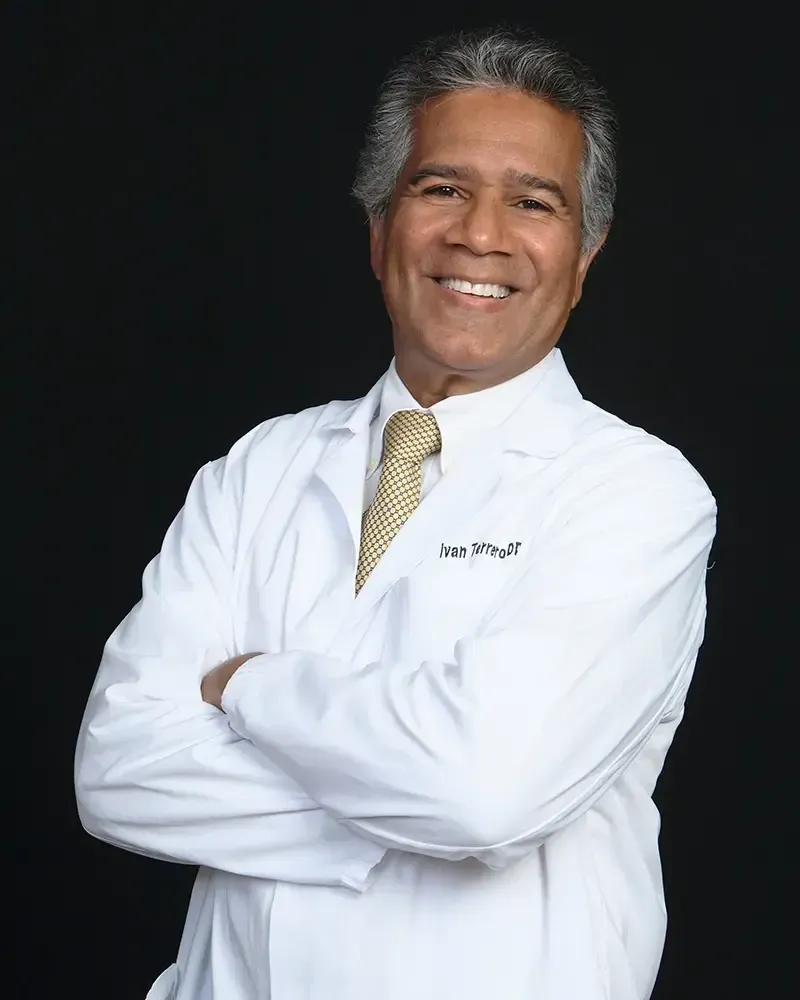

ABOUT US

My name is Ivan Terrero.

I have known that I wanted to be a dentist since I was 13 years old.

I graduated in 1986 in the Dominican Republic

to further my dentistry career and have now been practicing for 32 years, currently in Florida.

I've been involved with real estate investing for the last 25 years, buying land, offering creative financing including rent-to-own, being a private lender and flipping properties.

Today my preference is investing in mortgage notes and looking for real estate investment partners.

A mortgage note is a promissory note secured by property. The buyer makes payments to the Note holders as they would to a bank or other lender.

My goal is to grow a portfolio of investments with partners to provide cash flow and financial security.

Work with me to expand your investment portfolio to include real estate assets and mortgage notes.

I can work with you in Spanish.

— Ivan Terrero, The Note Doctor

FREQUENTLY ASKED QUESTION

What is trust deed investing?

Trust deed investing is a form of real estate investing where an investor loans money to a borrower secured by a deed of trust on a property. The investor becomes the lender and earns a fixed rate of return on the loan.

What are the benefits of trust deed investing?

The benefits of trust deed investing include the potential for higher returns compared to traditional investments, relatively low maintenance compared to owning and managing a property, and the ability to diversify a portfolio with real estate investments..

What are the risks of trust deed investing?

The risks of trust deed investing include default risk, market risk, interest rate risk, liquidity risk, legal risk, and due diligence risk.

How is the interest rate determined in trust deed investing?

The interest rate is typically determined by the lender and the borrower, and is based on factors such as the risk of the loan, the loan amount, and the loan term.

What types of properties can be used in trust deed investing?

Trust deed investing can be used for a variety of property types, including residential, commercial, and industrial properties. However, the property must have sufficient equity to support the loan.

What is the loan-to-value (LTV) ratio in trust deed investing?

The loan-to-value (LTV) ratio in trust deed investing is the ratio of the loan amount to the value of the property. In general, the LTV ratio in trust deed investing is lower than in traditional mortgage lending, as the lender wants to ensure that there is sufficient equity in the property to support the loan.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender can foreclose on the property to recover their investment. The foreclosure process can be lengthy and expensive, so it's important for investors to understand the risks involved in trust deed investing.

How can investors mitigate the risks of trust deed investing?

Investors can mitigate the risks of trust deed investing by conducting thorough due diligence on the borrower and the property, diversifying their portfolio, and working with experienced professionals such as financial advisors and real estate attorneys.

What is the minimum investment for trust deed investing?

The minimum investment for trust deed investing varies depending on the lender. Some lenders may require a minimum investment of $10,000, while others may require more.

Is trust deed investing right for everyone?

Trust deed investing is not suitable for everyone and requires a certain level of investment knowledge and risk tolerance. Investors should carefully consider the risks and benefits of trust deed investing before making a decision.

FREQUENTLY ASKED QUESTION

What is trust deed investing?

Trust deed investing is a form of real estate investing where an investor loans money to a borrower secured by a deed of trust on a property. The investor becomes the lender and earns a fixed rate of return on the loan.

What are the benefits of trust deed investing?

The benefits of trust deed investing include the potential for higher returns compared to traditional investments, relatively low maintenance compared to owning and managing a property, and the ability to diversify a portfolio with real estate investments..

What are the risks of trust deed investing?

The risks of trust deed investing include default risk, market risk, interest rate risk, liquidity risk, legal risk, and due diligence risk.

How is the interest rate determined in trust deed investing?

The interest rate is typically determined by the lender and the borrower, and is based on factors such as the risk of the loan, the loan amount, and the loan term.

What types of properties can be used in trust deed investing?

Trust deed investing can be used for a variety of property types, including residential, commercial, and industrial properties. However, the property must have sufficient equity to support the loan.

What is the loan-to-value (LTV) ratio in trust deed investing?

The loan-to-value (LTV) ratio in trust deed investing is the ratio of the loan amount to the value of the property. In general, the LTV ratio in trust deed investing is lower than in traditional mortgage lending, as the lender wants to ensure that there is sufficient equity in the property to support the loan.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender can foreclose on the property to recover their investment. The foreclosure process can be lengthy and expensive, so it's important for investors to understand the risks involved in trust deed investing.

How can investors mitigate the risks of trust deed investing?

Investors can mitigate the risks of trust deed investing by conducting thorough due diligence on the borrower and the property, diversifying their portfolio, and working with experienced professionals such as financial advisors and real estate attorneys.

What is the minimum investment for trust deed investing?

The minimum investment for trust deed investing varies depending on the lender. Some lenders may require a minimum investment of $10,000, while others may require more.

Is trust deed investing right for everyone?

Trust deed investing is not suitable for everyone and requires a certain level of investment knowledge and risk tolerance. Investors should carefully consider the risks and benefits of trust deed investing before making a decision.

Four Reasons To Invest In Notes

What a Note is and why it is a better option than being a landlord

Be the Bank

Through Note investing. No headaches of being a landlord having trouble tenants, toilets or trash. From your passive investments collect automatic payments directly into your Self Directed Retirement Account.

You are the Bank!

Give Back

By being the Bank, we are in a unique position to help the home-owners/borrowers by doing a loan modification. Turning a non-performing Notes into a performing Note, reestablishing Cashflow.

This fits our business model, Helping home owners stay in their homes!

Buy Right

Entry to any investment is key! Purchase correctly with the proper Due Diligence your mortgage Note or deed of trust investment will provide a safe, high-yield return secured by 1st position liens recorded against residential or commercial real estate.

Invest Wisely

Build a Legacy

Approaching retirement (or not), your investments in a Self-Directed IRA will compound building wealth. Your money is in the money business always working!

If you don't spend it all, you can leave a Legacy, generational wealth to those you love!

NoteDOCTOR

Four Reasons To Invest In Notes

What a Note is and why it is a better option than being a landlord

Be the Bank

Through Note investing. No headaches of being a landlord having trouble tenants, toilets or trash. From your passive investments collect automatic payments directly into your Self Directed Retirement Account.

You are the Bank!

Give Back

By being the Bank, we are in a unique position to help the home-owners/borrowers by doing a loan modification. Turning a non-performing Notes into a performing Note, reestablishing Cashflow.

This fits our business model, Helping home owners stay in their homes!

Buy Right

Entry to any investment is key! Purchase correctly with the proper Due Diligence your mortgage Note or deed of trust investment will provide a safe, high-yield return secured by 1st position liens recorded against residential or commercial real estate.

Invest Wisely

Build a Legacy

Approaching retirement (or not), your investments in a Self-Directed IRA will compound building wealth. Your money is in the money business always working!

If you don't spend it all, you can leave a Legacy, generational wealth to those you love!

Note Business

Subscribe to our newsletter

Don't miss any relevant offers

Our Portfolio of Companies

Expert Marketly

© All rights reserved. Made by The Note Doctor.

Subscribe to our newsletter

Don't miss any relevant offers

Our Portfolio of Companies

Expert Marketly

© All rights reserved. Made by The Note Doctor.